Professional Crypto Bookkeeper for Business-Grade Records

Clean crypto records. Tax-ready. Audit-ready.

Accurate crypto bookkeeping built for businesses operating across wallets, exchanges, and DeFi platforms. Classify and reconcile every transaction precisely to support compliant reporting with an experienced crypto bookkeeper.

- Reconciled 500M+ crypto transactions for businesses

- Trusted by Web3 companies, DAOs, and trading firms

- IRS-compliant financial records and reporting

JUST A FEW OF THE COMPANIES WE’VE SUPPORTED OVER THE YEARS

Why Crypto Bookkeeping Isn’t Optional for Crypto Businesses

Not every crypto transaction creates an immediate tax obligation, but every transaction must be recorded accurately. Otherwise, tracking your gains during tax season will become a complicated process. Disorganized crypto records also limit a business’s ability to plan effectively when working with a crypto bookkeeper or tax professional to assess tax exposure.

What’s taxable for your crypto business?

Some digital asset transactions trigger taxable events even when no fiat is involved, including:

- Token or asset swaps

- Selling crypto for USD or other currencies

- Earning staking rewards, yield, or interest

- Receiving airdrops or mining income

- Generating revenue from NFT sales

Each taxable event must be recorded with accurate dates, cost basis, and fair market value. When a business’s crypto bookkeeping is incomplete or inconsistent, reporting errors and compliance exposure increase.

What’s not taxable in crypto?

Certain transactions may not be taxable, but they still require proper recordkeeping, such as:

- Transfers between business-owned wallets

- Holding digital assets without disposition

- Internal wallet movements and treasury transfers

A crypto bookkeeper must still track these transactions to maintain audit-ready records and ensure gains, losses, and balances remain accurate.

How our crypto bookkeepers support your business

Businesses operating across wallets, exchanges, and DeFi protocols struggle with fragmented records. Our crypto bookkeeping process provides your business accurate records by:

- Collecting transaction data across all wallets, blockchains, and exchanges

- Cleaning, matching, and reconciling every transaction

- Classifying taxable and non-taxable activity accurately

- Producing reports that support IRS-compliant tax filing and financial review

Our target is to provide business owners and their finance teams reliable records they can trust.

Crypto Bookkeeping Services to Reconcile Business Bank Accounts and Crypto Wallets

Crypto Bookkeeping Services to Reconcile Your Traditional Bank Accounts and Crypto Wallets

Multi-Wallet & Multi-Chain Transaction Reconciliation

Tracking crypto activity across multiple wallets, blockchains, and exchanges can lead to fragmented records and reporting gaps. We synchronize all business wallets and platforms to build a complete, accurate ledger. When every transaction is properly matched and reconciled, your records support reliable reporting, tax compliance, and audit readiness year-round.

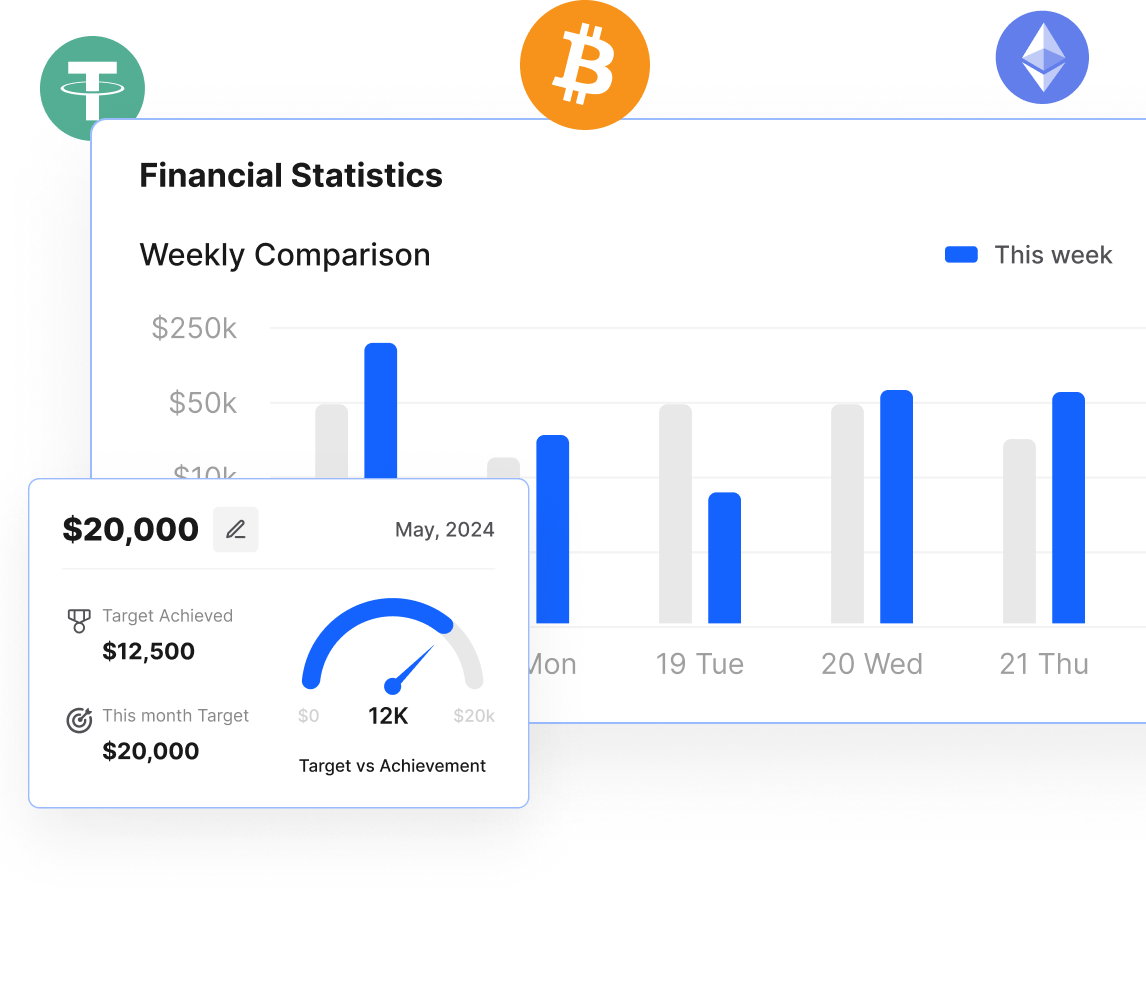

Crypto Bookkeeping

Our crypto bookkeepers handle day-to-day bookkeeping for both fiat and crypto transactions, providing businesses with accurate, up-to-date financial records. Accurate crypto bookkeeping is important to understand your business’s financial health in terms of profit, losses, taxes, and cash flow. We integrate automated accounting tools so your records stay in sync. When all crypto transactions are reconciled and organized, it’s easier for you to manage financial risks and make informed business decisions.

DeFi and NFT Accounting

Short for decentralized finance, DeFi is the umbrella term for financial services like staking, lending, and liquidity pooling that occur directly on public blockchains like Ethereum. NFTs (non-fungible tokens) are also decentralized financial services that come with reporting challenges, especially when it comes to sales, royalties, and airdrops. Each type of transaction has its own tax treatment. Our team understands the nuances of DeFi protocols and NFT marketplaces. We categorize transactions correctly, calculate cost basis, and prepare audit-ready records tailored to IRS requirements for businesses operating on-chain.

Crypto Mining Accounting

Crypto mining operations require accurate tracking of revenue, operating expenses, and capital assets. We support commercial mining activities by categorizing mining income, equipment costs, electricity expenses, and depreciation correctly. This ensures financial records reflect operational performance and support compliant tax reporting.

Crypto Tax Reconciliation

Managing records across multiple wallets, exchanges, and DeFi platforms can result in incomplete or inconsistent data. We handle crypto tax reconciliation by consolidating data from all platforms, matching every transaction, and correcting discrepancies. Clean reconciliation provides businesses with a clear financial picture that supports accurate tax reporting, audits, and financial review.

CFO Services

As Web3 businesses scale, clean bookkeeping must support broader financial oversight. Our CFO services provide structure across monthly reporting, expense management, treasury tracking, and budgeting with crypto-native precision. Built on accurate crypto bookkeeping, we help businesses organize on-chain activity, manage token incentives and protocol revenue, and deliver financial clarity that supports investor and stakeholder confidence.

Compliance and strategy

Reducing Financial Risk with Crypto Bookkeeping Services

Your business is ready for tax season with accurate records. Here’s how crypto bookkeeping helps you make informed growth decisions.

Clean Books = Clear Tax Reporting

Without clean records, crypto tax filing becomes guesswork. This is definitely risky since the IRS expects accurate transaction histories that include details on cost basis, holding periods, and gain/loss calculations. With crypto bookkeeping services, your accountant won’t be left struggling to interpret missing data. When data is missing, you’ll be making financial decisions without the whole picture.

Strategy starts with accurate numbers

Effective financial strategy depends on knowing where the business stands at any point in time. This is especially true for the crypto market that moves fast. If your wallet and protocol activity aren’t properly tracked, you won’t know your real profit or loss. Clean books organized by a crypto bookkeeper give insights to make decisions such as asset allocation, capital raises, or treasury planning.

Maintain compliance and reduce audit exposure

Regulatory oversight of digital assets continues to increase. In the US, requirements such as IRS Form 1099-DA expand reporting obligations for digital asset transactions. Consistent crypto bookkeeping keeps records audit-ready throughout the year, helping businesses reduce compliance risk and respond confidently to regulatory review.

Built for crypto-native operations

Traditional accounting tools like QuickBooks and Xero were not designed to handle high-volume, on-chain transactions from your business. Our crypto bookkeepers use crypto-native systems that integrate directly with wallets, exchanges, and protocols. This reduces manual work as well as the risk of error.

Clean Books = Clear Tax Reporting

Without clean records, crypto tax filing becomes guesswork. This is definitely risky since the IRS expects accurate transaction histories that include details on cost basis, holding periods, and gain/loss calculations. With crypto bookkeeping services, your accountant won’t be left struggling to interpret missing data. When data is missing, you’ll be making financial decisions without the whole picture.

Strategy starts with accurate numbers

Effective financial strategy depends on knowing where the business stands at any point in time. This is especially true for the crypto market that moves fast. If your wallet and protocol activity aren’t properly tracked, you won’t know your real profit or loss. Clean books organized by a crypto bookkeeper give insights to make decisions such as asset allocation, capital raises, or treasury planning.

Maintain compliance and reduce audit exposure

Regulatory oversight of digital assets continues to increase. In the US, requirements such as IRS Form 1099-DA expand reporting obligations for digital asset transactions. Consistent crypto bookkeeping keeps records audit-ready throughout the year, helping businesses reduce compliance risk and respond confidently to regulatory review.

Built for crypto-native operations

Traditional accounting tools like QuickBooks and Xero were not designed to handle high-volume, on-chain transactions from your business. Our crypto bookkeepers use crypto-native systems that integrate directly with wallets, exchanges, and protocols. This reduces manual work as well as the risk of error.

How Our Crypto Bookkeeping Process Works

We implement a structured crypto bookkeeping process designed to integrate with your existing accounting system.

Tailored Crypto Bookkeeping Services that Fit Your Business Workflow

Our crypto bookkeeping services are designed for businesses operating with digital assets at different stages of growth.

For Trading Firms and DeFi-Active Businesses

Businesses executing frequent trades or interacting with DeFi protocols require disciplined transaction tracking. We consolidate your transaction history, flag taxable events, and keep your books ready before tax season.

For Web3 Founders and Protocol Teams

Web3 companies manage token launches, contributor payments, and treasury activity alongside traditional operating expenses. Our crypto bookkeeping team tracks your crypto expenses and categorizes revenue streams to deliver accurate reports that are useful to your accountants, investors, and legal teams.

For Staking, Validation, and Mining Operations

Earning stake rewards or mining income? Then it’s critical to record each deposit with its timestamp and fair market value. Our cryptocurrency bookkeepers help you keep detailed logs and categorize operating expenses. This helps you get a clear view of your real income.

For DAOs and Crypto Treasuries

Your accounting starts on-chain when you are managing decentralized funds. However, auditors and stakeholders still expect traditional reports. You can make DAO finance more transparent by structuring records and categorizing token flows with crypto bookkeeping services.

For Small Businesses Accepting Crypto

Fiat-based accounting tools can’t track crypto payments in your business. Our crypto bookkeepers make sure that every crypto payment is tracked accurately in terms of pricing and the income type. These details are also merged with your general accounting records.

Why it matters

Why Standard Bookkeeping Doesn’t Work for Your Crypto Business

What Your Crypto Business Needs

Multi-wallet & chain reconciliation

DeFi, staking & NFT categorization

Cost basis calculation (FIFO/LIFO/HIFO)

Blockchain integration

Crypto tax report readiness

Real-time portfolio insights

IRS Compliance

General Bookkeeper

Manual and error prone

Misclassified or sometimes skipped

Limited

No direct sync with different wallets and exchanges

Needs extra work from tax pros

Hard to generate

General knowledge

Specialized Crypto Bookkeeper

Automated, backed by crypto-specific sub ledgers

Tracked and classified for compliance

Fully supported to suit your financial strategy

Syncs with protocols, exchanges, and wallets

Clean, categorized, and audit-ready

Monthly reports to make informed financial decisions

Up-to-date crypto-specific expertise

Join 175+ Blockchain Businesses That Trust OnChain Accounting

Tailored Crypto Bookkeeping Services that Fit Your Workflow

Let’s personalize crypto bookkeeping services for your solo crypto trading needs or your Web3 business that’s scaling.

For Active Traders & DeFi Users

We consolidate your transaction history, flag taxable events, and keep your books ready before tax season. With clean records, you don’t have to waste time reconciling swaps and transfers.

Crypto Bookkeeping

Our crypto bookkeepers handle day-to-day bookkeeping for both fiat and crypto transactions, giving you clear and updated financial records. Accurate crypto bookkeeping is important to understand your business’s financial health in terms of profit, losses, taxes, and cash flow. We integrate automated accounting tools so your records stay in sync. When all crypto transactions are reconciled and organized, it’s easier for you to manage financial risks and make informed business decisions.

DeFi and NFT Accounting

Short for decentralized finance, DeFi is the umbrella term for financial services like staking, lending, and liquidity pooling that occur directly on public blockchains like Ethereum. NFTs (non-fungible tokens) are also decentralized financial services that come with reporting challenges, especially when it comes to sales, royalties, and airdrops. Each type of transaction has its own tax treatment. Our team understands the nuances of DeFi protocols and NFT marketplaces. We categorize transactions correctly, calculate cost basis, and prepare audit-ready records tailored to IRS requirements whether you are farming yield or trading NFTs.

Financial Accuracy for Your Business

Poor Crypto Bookkeeping Leads to Costly Cleanups. Avoid These Mistakes.

A trusted crypto bookkeeper helps protect your business’s financial records for long-term growth and compliance.

Even if you are a fast-growing crypto business, if your bookkeeper fails to report income accurately or misses deductions, you'll find your financial growth slowing down.

Look out for these mistakes in your crypto bookkeeping process if the internal accounting team is handling it:

Missing cost basis on trades

When the cost basis for each crypto transaction is not tracked precisely, capital gains calculations become inaccurate (especially during audits).

Misclassified DeFi/Yield Income

If your bookkeeper mislabels income from staking, yield farming, or liquidity pools, this leads to underreporting or misreporting of income.

No Wallet-to-Wallet Transfer Tracking

Transferring crypto between your own wallets isn’t taxable. But your crypto bookkeeper should be documenting this activity. Otherwise, it may look suspicious to the IRS.

Lack of Transaction Reconciliation

Transactions across chains, exchanges, and wallets must be reconciled. If they’re not, your books could show missing income or double-counted expenses.

Manual Entry Errors

Is your bookkeeper manually entering data from multiple wallets and exchanges? This is not scalable, and it will eventually lead to costly mistakes.

Missing cost basis on trades

When the cost basis for each crypto transaction is not tracked precisely, capital gains calculations become inaccurate (especially during audits).

Misclassified DeFi/Yield Income

If your bookkeeper mislabels income from staking, yield farming, or liquidity pools, this leads to underreporting or misreporting of income.

No Wallet-to-Wallet Transfer Tracking

Transferring crypto between your own wallets isn’t taxable. But your crypto bookkeeper should be documenting this activity. Otherwise, it may look suspicious to the IRS.

Lack of Transaction Reconciliation

Transactions across chains, exchanges, and wallets must be reconciled. If they’re not, your books could show missing income or double-counted expenses.

Manual Entry Errors

Is your bookkeeper manually entering data from multiple wallets and exchanges? This is not scalable, and it will eventually lead to costly mistakes.

If a crypto bookkeeper with proper expertise manages your data, you can make sure that your business is expanding its crypto portfolio with minimal risks and lower costs.

These are the top benefits of hiring a trusted crypto bookkeeper for your business's accounting needs:

- Organized and verifiable records result in reduced audit risk.

- Proper records give transparency on your business’s real performance.

- You’ll be ready for tax filing, fundraising, and compliance at all times.

- All in all, clean and accurate reports are your opportunity to save time and resources.

FAQs

Your Questions, Answered

What is crypto bookkeeping, and how is it different from traditional bookkeeping?

Crypto bookkeeping is the process of tracking, categorizing, and reconciling cryptocurrency transactions. Unlike traditional bookkeeping, crypto activity requires blockchain-native tools and expertise to track on-chain activity and tax rules that are specific to digital assets.

Do I need a crypto bookkeeper if I already use a tax reporting platform like CoinTracker or Koinly?

Yes. Tax platforms summarize data for filing, but they don’t ensure your financial records are clean and accurate throughout the year. Bookkeeping is about ongoing recordkeeping, not just tax time. Our crypto bookkeepers ensure that every transaction is properly classified, reconciled, and ready for strategic financial planning, not just compliance.

Is the crypto bookkeeping process only for businesses and high-net-worth investors?

No. If you are transacting across wallets or platforms as an individual trader, proper crypto bookkeeping helps reduce your tax burden and avoid compliance issues. On a separate note, if you run a crypto business or fund, bookkeeping is non-negotiable for investor reports, audits, and crypto tax planning.

How often should cryptocurrency accounts be updated?

We recommend monthly reconciliation for your business to stay audit-ready and make informed decisions throughout the year. Our crypto bookkeeping service provides monthly financial statements so you can use these insights in real time.

Can your crypto accounting team help fix messy records from previous tax years?

Yes. If your books are incomplete or incorrect from past years, we offer cleanup services. We’ll go back, pull the missing data, reconcile the transactions, and work with your crypto tax professional to correct filings if necessary.