Experienced Crypto CPA for Business Tax & Compliance

Crypto Tax Strategy Built for Compliant Growth

Managing crypto taxes at the business level? Our crypto CPAs support companies operating with digital assets by delivering compliant reporting, defensible tax positions, and ongoing advisory aligned with U.S. and international regulations.

- Licensed crypto CPAs trusted by businesses, founders & funds

- 8+ years of combined crypto accounting experience

- IRS-compliant reporting, filings, & advisory services

JUST A FEW OF THE COMPANIES WE’VE SUPPORTED OVER THE YEARS

Audit-Ready Crypto Reporting for Growing Businesses

Digital assets introduce accounting and tax complexities that standard CPA practices are not equipped to manage at scale.

Crypto requires specialized accounting treatment

Crypto transactions are not treated the same as cash or traditional investments. A crypto CPA understands how to properly classify on-chain activity, including wallet transfers, staking rewards, and token transactions, so your records align with current tax and accounting guidance.

Accurate data supports confident tax reporting

Reliable tax filings depend on complete transaction records and correct cost basis tracking. A CPA for cryptocurrency ensures gains, losses, and income are calculated using reconciled data, helping your business file accurately and avoid issues caused by missing or inconsistent information.

IRS scrutiny is increasing

If your accountant can’t explain your crypto records and reconcile your accounts, your business is at risk of getting penalized. Our cryptocurrency accountants make sure that your books are audit-ready and your tax filings are compliant for any audit requests.

Specialized Crypto CPA Services for Business Accounting Requirements

We provide specialized crypto CPA services for businesses operating with digital assets.

Crypto Tax Compliance

Crypto tax compliance for businesses requires consistent oversight and accurate reporting across evolving regulations. Our crypto tax experts take care of your annual filings by making sure your capital gains, staking income, NFT sales, DeFi, or multi-wallet activity is reported correctly and on time. We apply accurate cost basis methods and IRS-compliant reports to file taxes properly. By planning ahead with strategies such as tax-loss harvesting, your business can manage tax exposure and reduce liability.

Crypto Bookkeeping

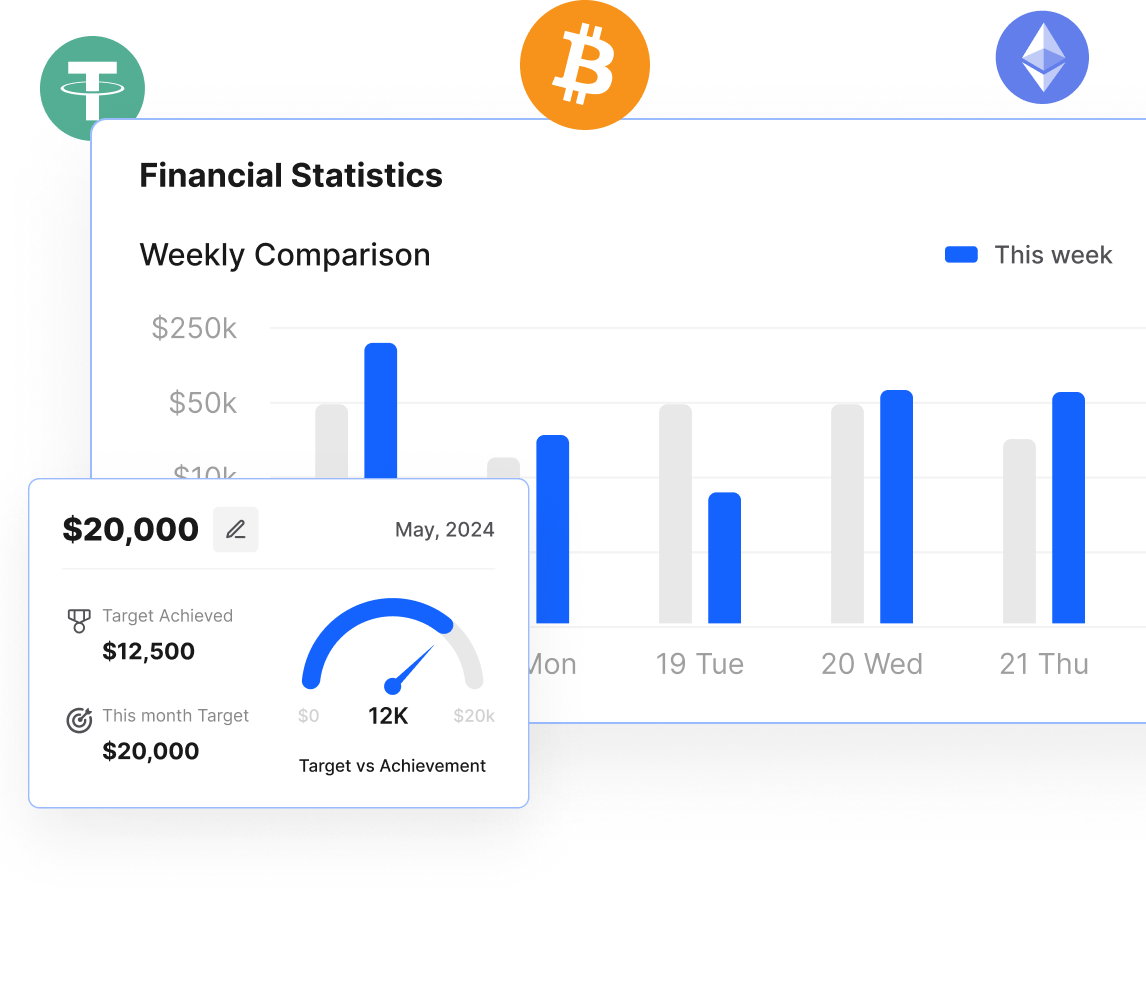

Our crypto bookkeepers handle day-to-day bookkeeping for both fiat and crypto transactions, giving you clear and updated financial records. Accurate crypto bookkeeping is important to understand your business’s financial health in terms of profit, losses, taxes, and cash flow. We integrate automated accounting tools so your records stay in sync. When all crypto transactions are reconciled and organized, it’s easier for you to manage financial risks and make informed business decisions.

DeFi and NFT Accounting

Short for decentralized finance, DeFi is the umbrella term for financial services like staking, lending, and liquidity pooling that occur directly on public blockchains like Ethereum. NFTs (non-fungible tokens) are also decentralized financial services that come with reporting challenges, especially when it comes to sales, royalties, and airdrops. Businesses engaging with DeFi protocols and NFT activity face complex classification and reporting requirements. Our team supports accounting for staking, liquidity provision, token sales, royalties, and airdrops by applying the correct tax treatment to each transaction type.

Crypto Mining Accounting

Crypto mining operations require accurate tracking of revenue, operating expenses, and capital assets. Businesses involved in mining face challenges with recording block rewards, managing fluctuating income, and accounting for equipment and energy costs. Our team supports commercial mining operations by categorizing mining income, capital expenditures, electricity costs, and depreciation correctly. This ensures financial records reflect operational performance and support compliant tax reporting.

Crypto Tax Reconciliation

Businesses operating across multiple wallets, exchanges, and DeFi platforms can encounter fragmented or inconsistent transaction data. CSV exports may not align, APIs can drop data, and internal transfers are frequently misclassified. We handle crypto tax reconciliation by consolidating data from all wallets, platforms, and protocols, matching transactions, and resolving discrepancies. Clean reconciliation provides a reliable financial record that supports accurate tax reporting, audits, and ongoing financial review.

CFO Services

Keeping your finances in order shouldn’t slow your business growth. At OnChain, we give Web3 teams the structure and visibility they need to grow responsibly. Our crypto financial controllers handle core functions like monthly reporting, expense management, and treasury tracking with crypto-native precision. We help you make sense of on-chain activity, organize your books, and deliver clean financials that keep investors and stakeholders confident. To stay financially agile, our crypto accountants manage token incentives and protocol revenue as well as budgeting in stablecoins.

Why it matters

Traditional CPA vs. Crypto CPA

Crypto has its own tax language for businesses that expert crypto CPAs know well.

Feature

Understanding blockchain transactions

Support for DeFi, NFTs, and staking

Multi-wallet and exchange reconciliation

Preparing Form 8949 & crypto tax reports

Planning tax-saving strategies

Support for audits

Traditional CPA

Might misclassify or overlook details

Unfamiliar

Manual accounting methods that cause errors

Not updated on IRS rules for crypto tax laws

Provides generic advice

Limited crypto experience

Crypto CPA

Has expert knowledge to classify transactions across wallets and swaps, including all on-chain activity

Specialized in yield farming, staking, airdrops, and NFT sales

Automated tools and in-depth review across wallets, chains, and protocols

IRS-compliant reporting for all transaction types

Crypto-specific tax planning (e.g., loss harvesting, deferral, optimal cost basis)

Accurate records, proper documentation, and audit-ready reports

Crypto Clients We Support

CPA Solutions for Businesses Operating with Digital Assets

Trading Firms & Investment Entities

Firms managing frequent trades across wallets and exchanges need accurate records to support reporting and compliance. Our crypto CPAs reconcile transaction activity, calculate gains and losses correctly, and prepare reports that stand up to audits and reviews.

Web3 Companies & Protocol Teams

Web3 businesses manage token launches, contributor payments, and treasury activity alongside day-to-day operations. We support protocol teams by keeping crypto records organized, classifying activity correctly, and delivering reports that investors, accountants, and legal teams can rely on.

Mining and Validation Operations

Businesses involved in mining or validation must track rewards, operating costs, and capital assets accurately. Our crypto bookkeepers help maintain clear records for income, expenses, and depreciation, ensuring financial reporting reflects actual operational performance.

DAOs and Digital Asset Treasuries

DAOs and crypto projects manage funds on-chain, but still need structured financial records for stakeholders and auditors. We help organize treasury activity, track token flows, and produce clear, audit-ready reports that support transparency and accountability.

Trading Firms & Investment Entities

Firms managing frequent trades across wallets and exchanges need accurate records to support reporting and compliance. Our crypto CPAs reconcile transaction activity, calculate gains and losses correctly, and prepare reports that stand up to audits and reviews.

Web3 Companies & Protocol Teams

Web3 businesses manage token launches, contributor payments, and treasury activity alongside day-to-day operations. We support protocol teams by keeping crypto records organized, classifying activity correctly, and delivering reports that investors, accountants, and legal teams can rely on.

Mining and Validation Operations

Businesses involved in mining or validation must track rewards, operating costs, and capital assets accurately. Our crypto bookkeepers help maintain clear records for income, expenses, and depreciation, ensuring financial reporting reflects actual operational performance.

DAOs and Digital Asset Treasuries

DAOs and crypto projects manage funds on-chain, but still need structured financial records for stakeholders and auditors. We help organize treasury activity, track token flows, and produce clear, audit-ready reports that support transparency and accountability.

Our Process to Get You Expert Help From a Crypto CPA

Common Crypto Compliance Risks for Businesses

Most crypto reporting risks come from incomplete data and misclassification.

Incomplete transaction records

Activity spread across wallets, exchanges, and protocols can lead to missing data. Incomplete records affect cost basis calculations and result in unreliable tax reporting.

Incorrect classification of crypto income

Staking rewards, airdrops, mining income, NFT royalties, and protocol incentives each require specific tax treatment. Misclassification distorts reported income and triggers issues during audits.

Unrecognized losses or offsets

Without accurate tracking of gains and losses, businesses may fail to apply allowable offsets, leading to overstated tax exposure.

Inconsistent cost basis and tax lot methods

Applying default methods without reviewing transaction history can produce inaccurate results. Businesses need consistent, well-documented methodologies to support filings.

Incomplete reporting for DeFi, NFTs, and cross-chain activity

Bridging assets, liquidity pool activity, wrapped tokens, and protocol interactions create taxable events. These must be identified and reported correctly to maintain compliance.

Incomplete transaction records

Activity spread across wallets, exchanges, and protocols can lead to missing data. Incomplete records affect cost basis calculations and result in unreliable tax reporting.

Incorrect classification of crypto income

Staking rewards, airdrops, mining income, NFT royalties, and protocol incentives each require specific tax treatment. Misclassification distorts reported income and triggers issues during audits.

Unrecognized losses or offsets

Without accurate tracking of gains and losses, businesses may fail to apply allowable offsets, leading to overstated tax exposure.

Inconsistent cost basis and tax lot methods

Applying default methods without reviewing transaction history can produce inaccurate results. Businesses need consistent, well-documented methodologies to support filings.

Incomplete reporting for DeFi, NFTs, and cross-chain activity

Bridging assets, liquidity pool activity, wrapped tokens, and protocol interactions create taxable events. These must be identified and reported correctly to maintain compliance.

Best Practices Our Crypto CPAs Use to Support Business Financial Control

For businesses operating with digital assets, accurate crypto accounting supports more than tax filings. It ensures leadership, finance teams, and external stakeholders can rely on financial data for planning, reporting, and decision-making.

Here’s what an experienced CPA for cryptocurrency can do differently to protect your business operations:

- Maintaining complete transaction records across all business wallets, exchanges, and protocols to support reliable reporting.

- Applying consistent cost basis methodologies so asset values, gains, and losses remain accurate across reporting periods.

- Recording crypto-related income events such as staking rewards, mining income, royalties, and protocol incentives within the business ledger.

- Standardizing reporting workflows to keep crypto activity aligned with existing accounting and finance processes.

- Supporting forward-looking planning so leadership can evaluate decisions with a clear view of the business’s financial position.

By following these practices, our expert cryptocurrency accountants ensure that your business is strategically positioned for success with a solid tax plan every year.

FAQs

Your Questions, Answered

Why does a business need a specialist CPA for cryptocurrency?

Once a business starts using digital assets beyond basic transactions, standard accounting support falls short. Specialists can make sure crypto activity is recorded correctly in alignment with IRS requirements as operations grow.

Can you support DeFi, staking, and NFT activity at the business level?

Absolutely. We support businesses engaging in protocol activity, token-based revenue, royalties, and on-chain transactions with income classification, cost basis tracking, and transaction reconciliation.

How will a crypto CPA handle missing and incomplete data?

Many businesses have fragmented data across wallets, exchanges, and protocols. Our crypto accountants use crypto-native tools to reconstruct transaction history, identify gaps, and reconcile activity so records are complete and ready for review consistently.

Do businesses still need specialist crypto accounting support if they use only one or two exchanges?

Yes. Exchange summaries are not designed for business accounting or entity tax filings. Transaction-level review is required to ensure gains, losses, and income are calculated accurately and reported precisely.

Are cryptocurrency accounting services only needed during tax season?

No. Businesses benefit most from year-round support. Ongoing reconciliation, reporting oversight, and planning reduce issues during audits, investor reviews, and year-end filings.

Can your crypto accounting firm support audits or investor reporting?

Yes. Our team of crypto CPAs, crypto tax planners, and crypto bookkeepers help prepare documentation, reconciled records, and reporting methodologies that support audits and regulatory reviews. We make sure your digital asset activity can be explained clearly and defensibly at any point.