Table of Contents

Hiring a bookkeeper who specializes in cryptocurrency accounting and taxes is key for crypto investors and traders who want to stay compliant and make informed decisions.

1. Why Crypto Bookkeeping Matters

The rapid growth of the crypto market has sparked intense interest but also confusion around crypto accounting and tax rules. Cryptocurrency transactions generate complex records across wallets and exchanges that require specialized expertise to handle properly.

Some key reasons it’s essential to have a crypto-savvy bookkeeper include:

- Maintaining accurate financial records: A bookkeeper tracks all crypto buy/sell activity, transfers, mining income, payments, lending activity, staking rewards, and more to provide transparent reporting.

- Tax compliance: Cryptocurrency is classified as property by the IRS, making it subject to capital gains tax rules that must be reported correctly to avoid penalties.

- Reducing risk: Experienced bookkeepers implement protocols around wallet access, transaction authorization, segregated duties, and cold storage that greatly improve security.

- Informed decision-making: By assessing profitability across coins and exchanges and providing key performance indicators, a bookkeeper gives crypto investors metrics to shape strategy.

Having meticulous records also provides investors, traders, and crypto businesses with the reporting needed to prove ownership, basis cost, and earnings if audited by tax authorities.

2. Maintaining Accurate Crypto Accounting Records

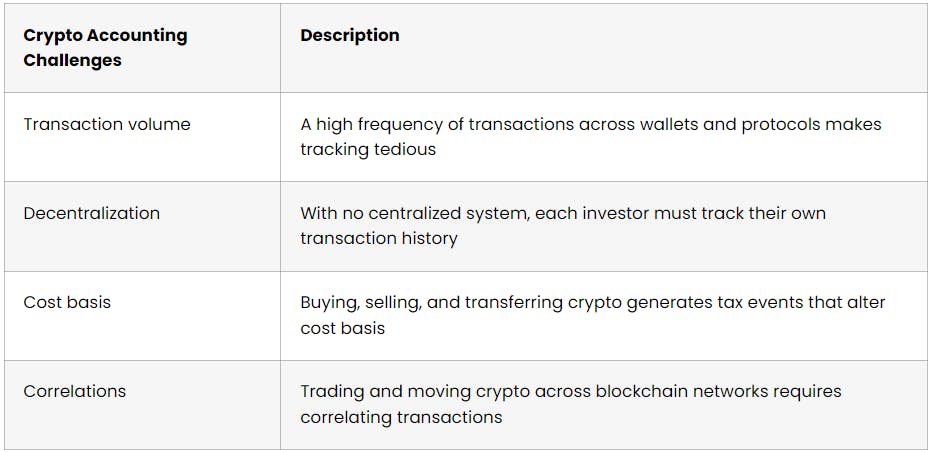

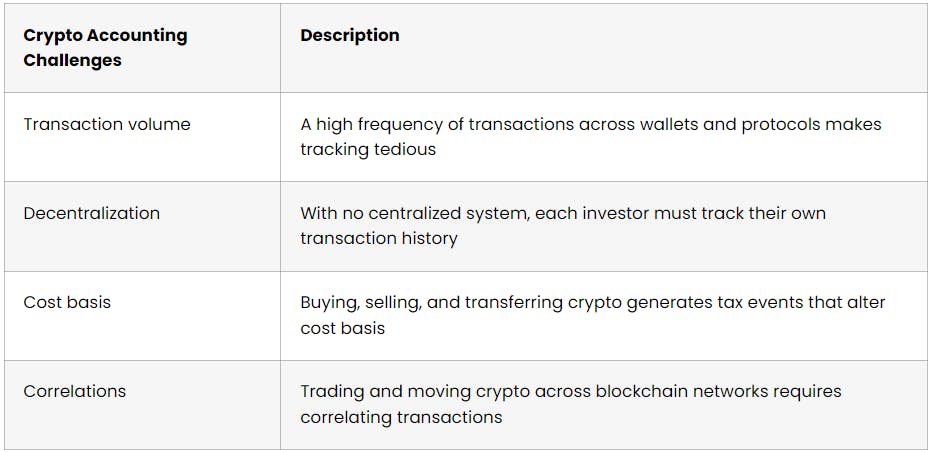

Bookkeeping in the crypto world is far more complicated than with traditional assets given factors like:

- Extreme price volatility

- Transactions across multiple wallets and exchanges

- Mining, staking, and yield opportunities

- Cost basis tracking after trading and transfers

- Correlating activity across blockchains

Without disciplined accounting and organization, it’s far too easy to lose track of buy prices, acquisition dates, transfer records, cash inflows/outflows, and other critical details. Such information gaps lead to incorrect tax filing, balance sheet errors that distort business performance, undetected theft and money laundering, and millions lost in overlooked riches sitting in wallets.

Full Ledger Needed

Crypto bookkeepers maintain a complete general ledger of every wallet owned and exchange used plus all crypto acquisition, sales, transfers in/out, mining payouts, staking activity, crypto loans, and other taxable events. This full transaction history satisfies IRS requirements and is prepared to avoid audit penalties.

Bookkeepers stay organized using trusted crypto accounting software tools like CoinTracker, CoinLedger, and CryptoTrader.Tax that sync with wallets and exchanges to auto-import activity. The best tools also support unlimited wallets/connections, historical data imports, cross-platform reporting, integrated tax forms, basis cost tracking, mining/staking income, and more – providing CPAs and investors with IRS-compatible reports.

Crypto Accounting Services Checklist

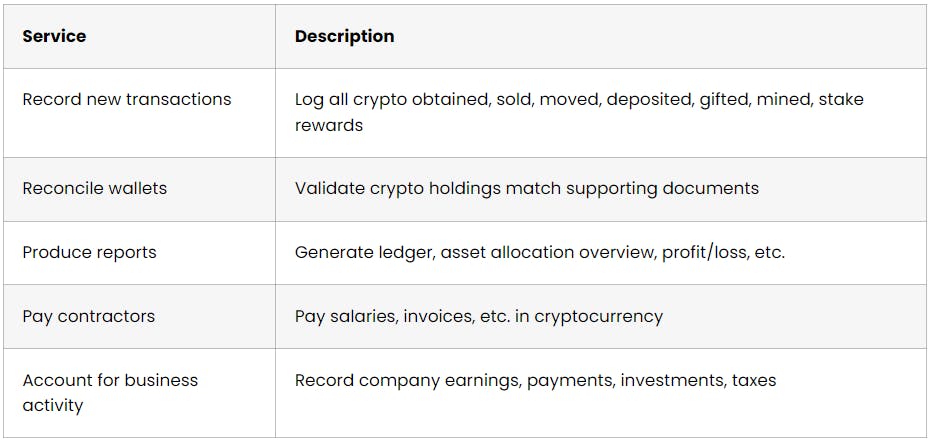

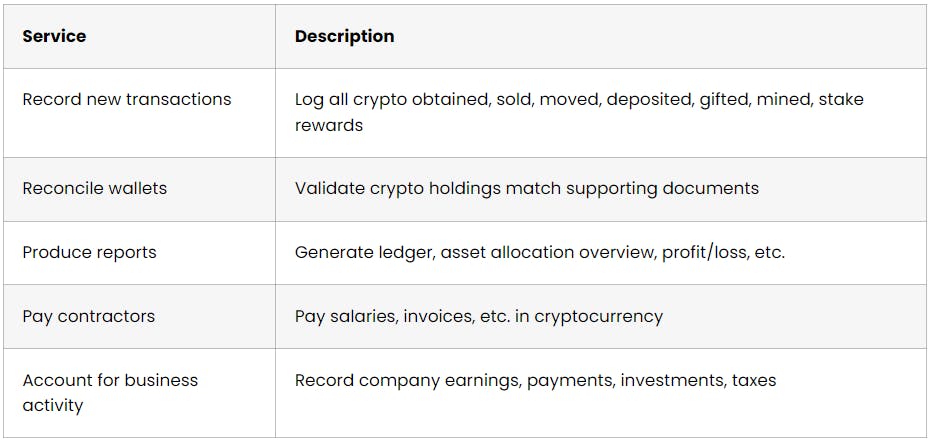

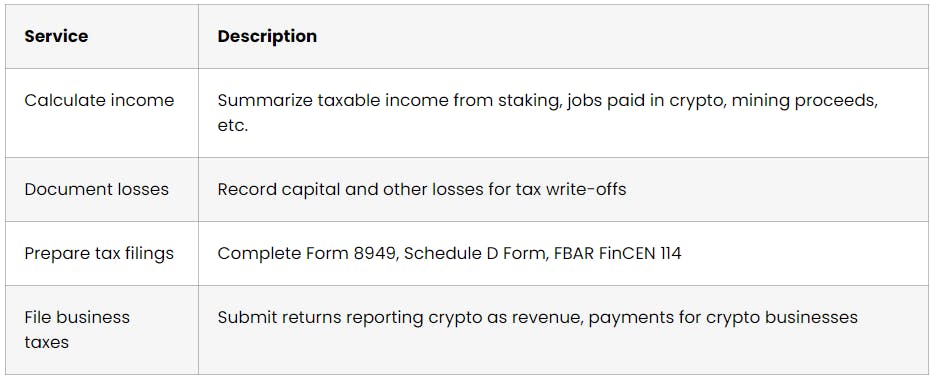

Here are standard accounting activities a crypto bookkeeper performs:

Ongoing Tasks

Quarterly/Annual Tasks

Ongoing Security

- Setup and restrict wallet/exchange access

- Implement hardware wallet cold storage

- Validate addresses when sending/receiving

- Monitor transactions

- Cybersecurity protocols

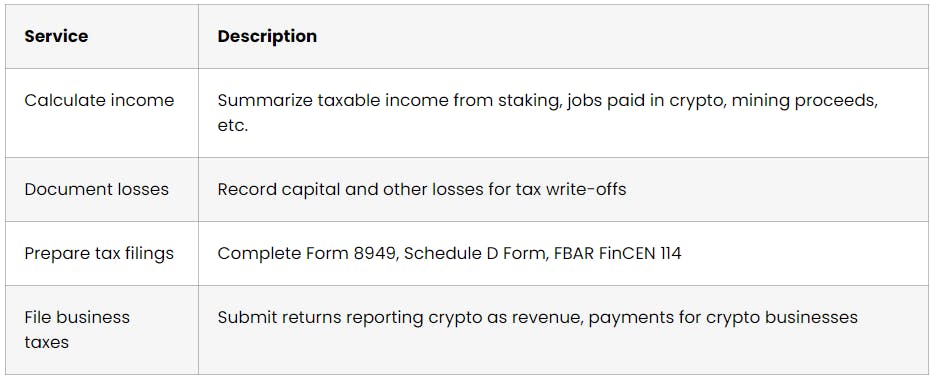

3. Complying with Cryptocurrency Tax Rules and Regulations

One reason crypto investors hesitate to cash out or use assets is confusion around crypto tax rules. The crypto bookkeeper serves as the tax expert guiding compliance across countries and states – alleviating stress for investors focused on trading strategies and portfolio growth.

Decentralization Creates Tax Events

Unlike bank accounts and brokerages that provide investors with consolidated 1099 tax forms, in the crypto world, the responsibility of compiling gains, losses, and income for tax reporting falls entirely on the user across each of their wallets and blockchain networks.

It’s critical investors understand crypto is treated as property, not as currency, by nearly every country’s revenue service. This means tax liability is generated by:

- Trading crypto assets: Any trades between coins triggers a taxable event, either a capital gain or loss.

- Converting fiat to crypto: Even using USD to purchase coins is a tax event requiring cost basis tracking and later gain/loss reporting when traded or sold.

- Using crypto to buy goods/services: Purchases made with crypto are subject to capital gains tax and must be reported.

- Earning crypto income: Income from jobs, mining, staking, lending, etc. that is paid in crypto must be reported.

Whenever crypto is exchanged for another coin, cash, or items – taxes apply.

Emerging Global Crypto Tax Regulations

While the U.S. pioneered early crypto tax policy, global regulatory bodies are now following suit as adoption spreads:

United States

- IRS: Crypto is property subject to capital asset gains/loss rates up to 37%

- States: State income tax also applies averaging up to 13%

European Union

AMLD5 (2020): Enacted stricter cryptocurrency Anti-Money Laundering and Know Your Customer standards

- TFR (2023): New Transfer of Funds Regulation expands coverage of crypto asset service providers

United Kingdom

Cryptoassets Manual (2021): Provides in-depth tax reporting rules for 150+ types of crypto transactions

Canada

- CRA: Charges capital gains plus goods/services tax on crypto payments

- OECD reporting forthcoming

Other global examples:

- Australia – Eliminated double taxation on crypto in 2022

- Germany – Uses the “FIFO rule” requiring owners calculate taxes based on longest-held coins

- Japan – Endorsed crypto as legal tender with gains taxed at a fixed 55%

- Singapore – No capital gains but has 18% goods and services tax on transactions

This changing landscape keeps crypto accounting complex. Letting a bookkeeper handle compliance allows investors to stay focused on trading.

4. Minimizing Risk Exposure

Since crypto resides on public blockchains, it creates immense opportunities for hackers, fraudsters, and cyber thieves leading many first-time investors to leave assets on vulnerable exchanges.

A bookkeeper brings organized processes to security using techniques like:

Multi-signature Wallets

Uses multiple sign-offs to approve asset transfers and restricts daily withdrawal limits per user. Prevents a single point of failure.

Threshold Signatures

Requires a minimum subset of signatures to validate transactions. Effective for businesses.

Allowlists

Restricts wallet addresses able to receive transfers to an approved list. Great for blocking scam attempts.

Hardware Wallets + Cold Storage

Stores majority of holdings offline immune from online attacks. Rate as the most secure storage method.

Audit Trails

Carefully documents each user’s access permissions history and transaction approvals allowing issues to be quickly traced.

The right controls and oversight applied consistently by knowledgeable accounting staff effectively minimizes the disastrous breaches making headlines.