The Critical Function of Crypto Tax Accountants

25th Jan 2024

Table of Contents

Why You Desperately Need a Crypto Tax Accountant

Crypto Tax Basics Your Accountant Should Grasp

What to Look for When Selecting a Crypto Tax Accountant

Average Fees Charged by Crypto Accountants

How Long Does Crypto Tax Reporting Take?

Crypto Tax Software vs Accountants: Which is Preferable?

Questions to Ask When Interviewing Crypto Tax Accountants

Crypto Accounting: Additional Services to Request

10 Best Practices for Recording Crypto Activity and Holdings

Crypto Donations: Tax Benefits Explained

Warning Signs of Crypto Tax Fraud

Crypto Accounting Checklist to Prepare

Crypto Tax Planning Opportunities Beyond Income Reduction

As cryptocurrencies gain mainstream traction, proper crypto tax reporting is becoming increasingly complex. This comprehensive guide covers everything you need to know about crypto tax accountants—why you need one, their key responsibilities, the tax implications they can help you navigate, what to look for when choosing one, average costs, and if tax software is a viable alternative.

1. Why You Desperately Need a Crypto Tax Accountant

Dealing with crypto taxes on your own is possible but perilous. Without expertise, you risk incorrect filings, penalties, audits, or unrealized tax savings. A competent crypto tax accountant can:

- Handle convoluted virtual currency tax rules: Cryptocurrency tax guidance is convoluted, with confusing implications for trading, staking, mining, NFTs, and DeFi activities. Navigating this alone can lead to misreporting or overpayment.

- Complete accurate tax forms: A crypto tax professional can accurately prepare Schedule 1, Schedule D, Form 8949, and other forms reflecting your crypto activity.

- Use specialized crypto tax software: Accountants have access to sophisticated software like CoinTracker and ZenLedger to generate crypto tax reports and filings.

- Avoid penalties and audits: Incorrect crypto tax filings greatly raise your chances of being audited and facing stiff penalties from the IRS. A crypto tax accountant significantly mitigates this risk.

Main Responsibilities of a Competent Crypto Tax Accountant

If you decide to enlist an accountant to handle your cryptocurrency taxes, some of their key duties should include:

- Calculating capital gains and losses: For each taxable crypto sale or trade you conducted, they will compute the corresponding capital gain or loss for tax reporting. This entails reviewing purchase and sale prices.

- Preparing core tax forms: They will complete Schedule D, Form 8949, Schedule 1, and any other required IRS forms to reflect your crypto transactions.

- Reviewing transaction histories: Your accountant will need to analyze transaction histories from all your exchanges and wallets to account for every taxable activity.

- Determining income sources: In addition to trading gains/losses, they will identify any taxable income from staking rewards, mining, air drops, forked coins, and other means.

- Finding deductions: They will uncover any allowable deductions that can be claimed related to your crypto activities, such as fees, hardware costs, home office deductions, etc.

- Submitting disclosures: If your foreign or aggregate crypto holdings trigger FBAR or other reporting requirements, your accountant will file these disclosures.

2. Crypto Tax Basics Your Accountant Should Grasp

Ideally, your chosen crypto tax accountant will have mastery over core tax rules that apply to various cryptocurrency activities, including:

Trading and Investing Tax Implications

- Like-kind exemption: Trading one crypto for another (e.g., BTC for ETH) used to qualify for Section 1031 like-kind tax exemption, but no longer after 2018 tax reform. Now taxable.

- FIFO vs. LIFO: The IRS doesn’t mandate using first-in first-out (FIFO) or last-in first-out (LIFO) cost basis calculations, but your methodology must be consistent.

- Wash sale rule: If you sell a crypto for a loss and rebuy it within 30 days, the wash sale rule disallows claiming the capital loss under certain conditions.

Staking, Mining, and Income Tax Considerations

- Staking rewards: Rewards earned for staking crypto (validating proof-of-stake networks) constitutes taxable income, even if unclaimed.

- Mining income: Crypto mining counts as taxable income equal to the fair market value of coins mined at that time. This includes coins later used to cover electricity costs.

- Forks and airdrops: Receipt of coins via a hard fork or airdrop constitutes taxable income per IRS guidance. The value the day of receipt determines how much income to report.

NFT and DeFi Tax Reporting Rules

- NFT creation and sales: You owe income tax when initially selling an NFT. If held over a year before selling, capital gains tax rates may apply instead depending on factors like creator vs. collector status.

- NFT royalties: Royalty payments from secondary NFT sales accrue as ordinary taxable income. These don’t qualify for capital gains treatment.

- Yield farming/liquidity pools: Rewards for providing liquidity to DeFi protocols are taxed as ordinary income. Further income or capital gains tax applies when removing liquidity.

This covers some of the essential tax treatment nuances, but many others apply to specific situations. A seasoned crypto accountant will stay on top of the latest guidance and considerations.

3. What to Look for When Selecting a Crypto Tax Accountant

Not all tax professionals are created equal when it comes to crypto accounting services. As you vet candidates, watch for:

- Deep crypto tax specialization: Ask pointed questions to assess their experience with crypto clients, forms filed, and mastery of asset types and activities.

- CPA credential: A Certified Public Accountant (CPA) designation indicates advanced tax expertise and accountability standards.

- Up-to-date guidance knowledge: Do they proactively maintain updated understanding of latest IRS guidelines and rulings around crypto taxation?

- Crypto-savvy software skills: Do they use leading crypto tax solutions like CoinTracker or ZenLedger to generate complete reports?

- Detailed discovery questions: Did they probe comprehensively about your crypto holdings, activities, entities, residencies, income ranges and more during onboarding?

- Clear pricing and payment terms: What is their exact fee structure? Do they offer fixed price packages or hourly rates? What payment methods do they accept?

- Strong client reviews: Check sites like Google, Facebook and Yelp for ratings and testimonials from other crypto clients.

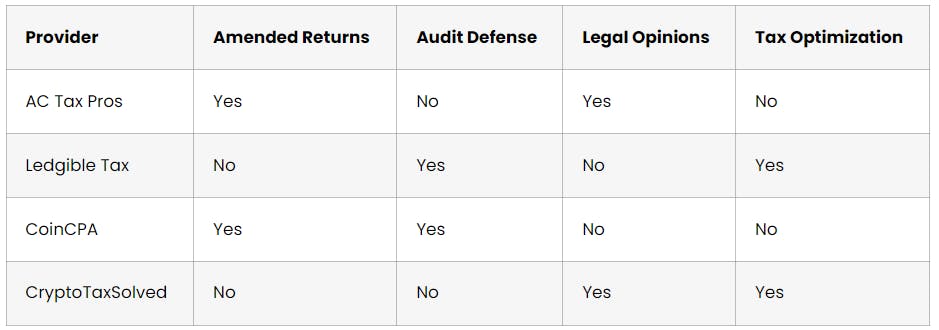

Here is a comparison table of top crypto tax accounting service providers:

4. Average Fees Charged by Crypto Accountants

Expect to pay anywhere from $200 to $2,500+ for crypto tax return preparation by an accountant, with the average cost around $750. Factors impacting pricing include:

- Number of years filing crypto taxes

- Types of crypto activity (staking, DeFi, NFTs etc.)

- Overall transaction volume

- Number of exchanges/wallets integrated

- Supplementary services needed (audit/penalty defense)

You can reduce costs by gathering all tax forms, transaction histories, income records, entity details, and other materials the accountant will need up front. Provide organized information and clearly communicate your crypto activities. This streamlines their processing and cuts billable hours.

5. How Long Does Crypto Tax Reporting Take?

Another variable factor is turnaround time, though most accountants can deliver filed tax returns for crypto clients within 2-6 weeks. Again, having organized source data cuts down prep time.

Delays may happen during peak tax season from February-April when accountants experience high customer volumes. For fastest turnaround, engage as early in the year as possible.

6. Crypto Tax Software vs Accountants: Which is Preferable?

Crypto-specialized tax software like CoinTracker, ZenLedger, Koinly and others can automate much of the transaction data aggregation, gain/loss calculations, form filling and filings. Features and monthly subscription fees vary widely.

For those with extensive or complex crypto activity, most tax software lacks the ability to handle nuanced situations. The AI also can’t provide informed judgement for gray areas like the crypto tax experts behind top accounting firms can. Yet for simpler cases, quality software may suffice at a fraction of the cost.

BOTTOM LINE: For comprehensive crypto tax reporting that protects you from IRS penalties and audits while uncovering every permissible deduction, reputable crypto tax accountants prove well worth their fees. Just be sure to thoroughly vet candidate experience.

7. Questions to Ask When Interviewing Crypto Tax Accountants

Don’t take someone’s word that they are competent in crypto tax reporting. Thoroughly vet them first, such as by asking these key questions:

- How many years of experience do you have specifically preparing cryptocurrency tax returns?

- What percentage of your client base deals with crypto assets and activities?

- Which forms, schedules, and documentation are you familiar generating for crypto clients?

- What training have you received on recent IRS guidance like Notice 2014-21 and Rev. Rul. 2019-24?

- Which crypto exchanges, wallets, protocols, and networks have you handled tax reporting for?

- How do you make determinations on crypto cost basis, tax lots, and accounting methods?

- What crypto-specialized software, tools and dashboards do you utilize? May I see a demo?

- Can you handle multi-country tax implications from my cryptocurrency holdings and activities?

- How do you approach disclosure requirements like FBAR, FATCA, and Form 8938?

- How do you identify and document tax deductions related to my crypto earnings?

- What is your methodology for uncovering crypto tax optimization opportunities?

- What support do you provide if audited for my crypto taxes?

- Can you provide references from other crypto clients you service?

Their responses will prove telling as to their breadth of crypto tax expertise across trading, staking, DeFi, NFTs, and more. You deserve precise, confident answers demonstrating true specialization.

8. Crypto Accounting: Additional Services to Request

Beyond core crypto tax return preparation, inquiry if they offer:

- Amended filing support: If you forgot to report crypto income or activities from prior years, determining what amended returns the IRS requires can prove tricky.

- FBAR and FATCA filing assistance: Do they submit Foreign Bank Account Reports (FBARs), Foreign Account Tax Compliance Act (FATCA) forms, and other international disclosures pertaining to crypto?

- Penalty and audit defense: Find out what support they provide if the IRS challenges a return they prepared to impose fines or other enforcement action. Will they represent you?

- Legal opinions: Can they deliver legal memorandums with cited statute to reinforce tax positions taken on grey areas like staking rewards or claiming losses on security classification violated coins?

- Tax savings optimization: Do they proactively advise tax reduction strategies related to your crypto holdings like tax-advantaged donation, retirement rollover, opportunity zone investing, or trust structuring?

Table comparing core cryptocurrency tax reporting services:

Charging separately for these supplementary offerings enables the provider to offer lower base preparation pricing while allowing clients who need extra services to select them á la carte.

Just ensure you know what exactly is and isn’t baked into bundled packages before signing any contracts. Get clear deliverables and pricing in writing upfront.

9. 10 Best Practices for Recording Crypto Activity and Holdings

You can accelerate tax prep, enhance reporting accuracy, and reduce accountant fees if you:

- Track transactions diligently: Log every crypto buy, sell, trade, transfer along with purchase/sale price, fees, date/time, counterparties.

- Document income types: Record details on coins acquired from mining, staking rewards, forks, airdrops, payments.

- Retain tax forms: Keep Form 1099-Ks, K-1s, and other tax statements generated by exchanges and crypto payment processors.

- Organize wallet data: Export complete transaction histories from all wallets and exchanges, ideally to CSV or native utility file formats.

- Record costs: Keep receipts and track costs for equipment, electricity, fees, related services to deduct against crypto income.

- Take screenshots: Capture periodic screenshots of wallet/portfolio balances and token counts to support holdings, bases, gains, losses.

- Back up files: Store copies of all wallet export files, transaction logs, tax forms, receipts on separate drives or offline. Consider encrypted cloud backups.

- List all entities: Document any trusts, partnerships, LLCs, corps holding crypto assets tied to you as the taxpayer.

- Note foreign ties: Disclose offshore exchange accounts, wallets, activities, residencies, citizenships, signatories.

- Keep for years: Retain digital records described for at least 3-7 years depending on tax form. Print key documents as well.

Thorough tracking and recordkeeping alone can avert 90% of cases that trigger IRS penalties and enforcement. Don’t expect your accountant to recreate missing histories–the onus falls upon you as the taxpayer.

10. Crypto Donations: Tax Benefits Explained

Donating cryptocurrency enables claiming a tax deduction for the full fair market value while avoiding capital gains tax you would incur from selling the coins first. This legal tax strategy essentially subsidizes your donation courtesy of the IRS. Consider:

- You purchased 1 BTC in 2015 for $300

- Bitcoin price reached $48,000 by 2021

- You donate 0.5 BTC to a 501(c)(3) nonprofit

- Tax deduction = $24,000 (0.5 BTC x $48,000 per BTC)

- Saved $7,875 in tax (15% LTCG rate x $24,000 gains had you sold first)

Be sure to obtain a contemporaneous written acknowledgment of the donation from the recipient organization. Try donors advised fund groups like Fidelity Charitable which make crypto giving easy through your DAF account.

For sizable donations exceeding $5,000 in value, you’ll also want to procure a qualified appraisal from a reputable firm to attach with your tax return. If you plan to conduct crypto charitable giving, advise your tax accountant beforehand so they handle requisite claiming procedures correctly.

11. Warning Signs of Crypto Tax Fraud

The last thing you want is to select an unethical crypto accountant who prepares inaccurate, misleading or fraudulent tax returns under your name as the taxpayer. While most credentialed professionals have integrity, remain vigilant of:

- Promises of too-good-to-be-true tax refunds: Quality accountants never guarantee or estimate refund amounts without reviewing full tax pictures first.

- Encouraging aggressive tax positions: Competent CPAs advise playing it safe with reasonable tax interpretations, not overly risky grey areas merely to minimize cryptocurrency taxes in the short run.

- Lack detailed questions or documentation requests: Reputable accountants extensively vet client crypto activity, entities and situations before finalizing returns. Insufficient diligence telegraphs trouble.

- Absence of client invoice/agreement: Top firms always provide engagement letters or service agreements detailing work, associated fees, terms and conditions for client consent. No paperwork hints at deceptive tax preparation.

- Unwillingness to sign tax returns: Ethical accountants stand behind their work by affixing preparer tax identification numbers and signatures on filed returns, issuing itemized invoices describing services rendered.

Seeking the cheapest hastily-prepared tax returns often proves painfully penny wise pound foolish once the IRS eventually flags fictional tax data. Work exclusively with credible crypto tax preparation professionals to simultaneously minimize legal tax obligations and avoid fines or worse.

12. Crypto Accounting Checklist to Prepare

Compiling pertinent information elements ahead of time makes your accountant’s job easier while avoiding supplemental fact finding billable hours. Be sure to have available:

☐ Complete exchange account transaction histories

☐ Export files from all wallet apps used

☐ Income records from staking, mining, airdrops

☐ Supporting data on crypto donations made

☐ Purchase receipts and acquisition dates for all cryptocurrency buys

☐ 1099 tax statements from crypto services used

☐ Details on hard forks resulting in any coin holdings

☐ List of all taxable crypto sales/trades with dates and sale prices

☐ Itemization of costs tied to cryptocurrency activities

☐ FBAR/FATCA reporting confirmation if thresholds met

☐ Full legal names of any entities tied to crypto holdings

Supplying comprehensive materials as described minimizes back and forth along with accountant fees while expediting turnaround on completed filings. Make their job easier plus save yourself money.

13. Crypto Tax Planning Opportunities Beyond Income Reduction

Savvy crypto accountants bring more to the table than just timely, accurate tax return preparation and income reduction via deductions, losses, credits, exclusions and the like. They open your eyes to little-known planning opportunities spanning:

Crypto Donor Advised Fund (DAF): Create your own quasi-private foundation using appreciated cryptocurrency for funding while scoring a hefty tax deduction and future grant distribution control.

Opportunity Zone Crypto Fund: Invest pinned-up crypto capital gains into qualified opportunity zones to earn powerful temporary and permanent tax reductions.

Crypto IRA/401k Rollover: Legally move IRA retirement funds into cryptocurrency without early withdrawal penalties via account transfer or 60-day rollover rule while continuing tax deferred/free compounding growth.

Crypto Protection Trust: Shift cryptocurrency into an irrevocable trust to minimize estate taxes down the road while preserving asset control and appreciation benefits in the meantime.

Work closely with your crypto-savvy CPA and tax attorney to weigh alternative tax mitigation structures beyond ordinary income tax prep. Understand how timing transactions and holdings across tax years increases planning flexibility for major tax savings over long-term horizons.