DeFi

Empowering DeFi Analytics: OnChain Accounting’s Strategic Partnership with DeFi Pulse for Enhanced Financial Reporting and Compliance

Table of Contents

#1 DeFi Index in the World

Client Overview

Challenges Faced

Engagement with OnChain Accounting (OCA)

Solutions Provided

Results Achieved

Client Testimonial

Conclusion

1. #1 DeFi Index in the World

The DeFi Pulse Index represents a capitalization-weighted index, monitoring the performance of decentralized finance (DeFi) assets on the Ethereum network. It merges the characteristics of an ERC-20 token with those of a conventional structured product, offering a modern, digital enhancement to structured products for the 21st century.

2. Client Overview

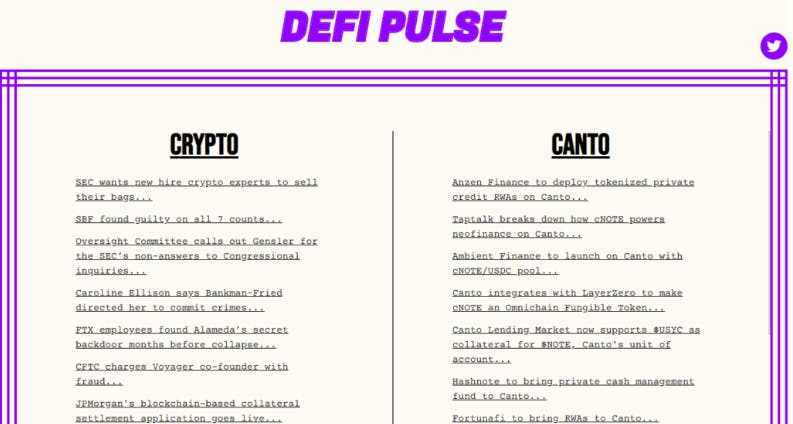

DeFi Pulse stands at the forefront of the decentralized finance (DeFi) industry, offering critical data and analytics on DeFi protocols and assets. Their platform, known for tracking the total value locked in various DeFi protocols, is instrumental for investors and users navigating the DeFi space. However, managing their extensive transaction data, especially reconciling over 500,000 transactions primarily from DeFi operations, presented a formidable challenge.

3. Challenges Faced

DeFi Pulse’s operational landscape was marked by unique complexities:

- Diverse DeFi Transaction Types: DeFi Pulse’s transactions included a range of activities such as liquidity pooling, yield farming, staking, and token swaps. Each type required specific accounting treatments due to their unique risk profiles and revenue models.

- Dynamic Nature of DeFi Protocols: The rapidly evolving DeFi protocols meant that the transaction types and their implications were constantly changing, necessitating an adaptive accounting approach.

- Integrating DeFi Transactions with Traditional Systems: Merging DeFi transaction data with traditional accounting systems was a critical yet intricate task, requiring deep understanding and technical capability.

4. Engagement with OnChain Accounting (OCA)

Seeking expertise in the niche field of crypto and DeFi accounting, DeFi Pulse partnered with OCA. OCA’s proficiency in handling complex DeFi transactions and their ability to integrate these with conventional accounting systems made them an ideal partner.

5. Solutions Provided

OCA crafted a multi-faceted approach tailored to DeFi Pulse’s specific needs:

- Development of a Custom DeFi Accounting Framework: Recognizing the varied nature of DeFi transactions, OCA developed a customized accounting framework. This system was designed to accurately capture the nuances of each DeFi transaction type, from simple token transfers to more complex interactions like smart contract executions.

- Extensive Transaction Categorization and Reconciliation: With over 500,000 transactions, OCA employed advanced categorization techniques, distinguishing between capital gains, interest income, liquidity pool rewards, and more. Each category had its own set of accounting treatments, ensuring compliance and accuracy.

- Crypto Sub-Ledger Integration: OCA integrated a crypto sub-ledger system to manage and reconcile DeFi transactions. This sub-ledger worked in tandem with DeFi Pulse’s existing financial systems, enabling seamless data flow and providing a granular view of each transaction.

- Regular Updating of Accounting Protocols: Given the dynamic nature of DeFi, OCA ensured regular updates to the accounting protocols, aligning them with the latest DeFi trends, protocols, and regulatory changes.

- Strategic Financial Analysis and Reporting: Beyond transaction reconciliation, OCA provided DeFi Pulse with in-depth financial analysis, highlighting the financial implications of various DeFi activities. This included profitability analysis, risk assessment, and liquidity evaluation.

- Regulatory Compliance and Advisory: DeFi Pulse benefited from OCA’s expertise in navigating the complex regulatory landscape of DeFi. OCA provided ongoing advisory services to ensure compliance with emerging regulations and standards.

6. Results Achieved

The partnership yielded significant advancements:

- Accuracy in Financial Reporting: The tailored DeFi accounting framework allowed for precise financial reporting, crucial for DeFi Pulse’s credibility and operational success.

- Operational Efficiency and Scalability: The streamlined process significantly reduced manual effort, paving the way for scalability in handling an increasing volume of complex transactions.

- Empowered Decision-Making: With access to accurate and detailed financial data, DeFi Pulse could make more informed strategic decisions, enhancing their position in the DeFi market.

- Adherence to Regulatory Standards: The comprehensive approach ensured that DeFi Pulse remained compliant with the evolving regulatory environment, mitigating risks associated with non-compliance.

7. Client Testimonial

DeFi Pulse lauded OCA for their exceptional service, noting the firm’s deep understanding of DeFi intricacies, professionalism, and the bespoke nature of their solutions. OCA’s contribution was pivotal in enhancing DeFi Pulse’s operational efficiency and financial integrity.

8. Conclusion

OCA’s intervention was crucial in transforming DeFi Pulse’s approach to DeFi transaction accounting. By addressing the specific challenges of DeFi transactions and integrating these with traditional accounting practices, OCA not only streamlined DeFi Pulse’s financial operations but also equipped them with the tools and insights needed to thrive in the dynamic and complex world of decentralized finance.

Don't Hesitate to Invest Now, We Will Give You The Best!

Onchain Accounting stands as your vigilant financial co-pilot, ensuring compliance and peace of mind.

In the fast-paced decentralized finance (DeFi) sector, DeFi Pulse was a pioneering entity. With a focus on providing key analytics and insights into the DeFi market, they aimed to expand their influence and reshape how investors engage with DeFi protocols. Their ambitious goal: secure significant funding to become a leading authority in the DeFi landscape.

Life with Onchain Accounting

Streamlined and Structured Financial System

OnChain Accounting implemented a sophisticated system tailored to DeFi transactions, integrating DeFi Pulse’s activities across multiple platforms into a cohesive financial framework.

Transparent and Detailed Financial Reporting

By categorizing and recording all transactions accurately, OnChain Accounting provided DeFi Pulse with a clear and transparent view of their financial operations, enhancing trust and reliability among stakeholders.

Robust Financial Strategy and Forecasting

Leveraging the organized financial data, OnChain Accounting developed a comprehensive financial strategy for DeFi Pulse, including detailed forecasting models. This enabled effective planning for future investments and operational scaling in the DeFi space.

Boosted Investor Confidence

With OnChain Accounting’s expertise, DeFi Pulse was able to produce clear, detailed financial statements and forecasts, significantly enhancing their narrative to investors. This clarity and professionalism were instrumental in securing vital investment for growth and innovation.

Enhanced Strategic Financial Decision-Making

Equipped with accurate financial insights and continuous support from OnChain Accounting, the DeFi Pulse team gained the ability to make informed, strategic financial decisions. This newfound financial clarity empowered them to navigate the complex DeFi landscape more effectively, seizing opportunities and mitigating risks.

Life before Onchain Accounting

Complex and Unorganized Financial Data

DeFi Pulse faced a complex scenario with their financial records scattered across various decentralized finance platforms and wallets. The lack of a centralized system led to unorganized financial data, making it challenging to track and manage assets efficiently.

Opacity in Financial Reporting

Without a specialized crypto sub-ledger or an efficient tracking system, DeFi Pulse struggled to maintain transparency in their financial operations. This was particularly problematic in illustrating the flow of funds and the performance of assets, crucial for trust and credibility among users and investors.

Insufficient Financial Planning and Forecasting

The absence of a coherent financial strategy and forecasting mechanism hindered DeFi Pulse’s ability to effectively strategize for future growth, expansion, and adaptation in the rapidly evolving DeFi market.

Challenges in Securing Investor Confidence

The unclear and disorganized financial statements made it difficult for DeFi Pulse to present a compelling case to potential investors, impacting funding opportunities essential for innovation and growth in the DeFi sector.

Restricted Decision-Making Capabilities

Lacking a comprehensive overview of their financial health, the DeFi Pulse team was constrained in making strategic financial decisions, affecting their ability to capitalize on market opportunities and manage risks.