Zeta Markets

Speed and Precision: How OnChain Accounting Revolutionized Zeta Markets’ Crypto Bookkeeping and Trading Operations

February 2023

Table of Contents

Client Overview

Challenges Faced

Engagement with OnChain Accounting (OCA)

Solutions Provided

Results Achieved

Client Testimonial

Conclusion

1. Client Overview

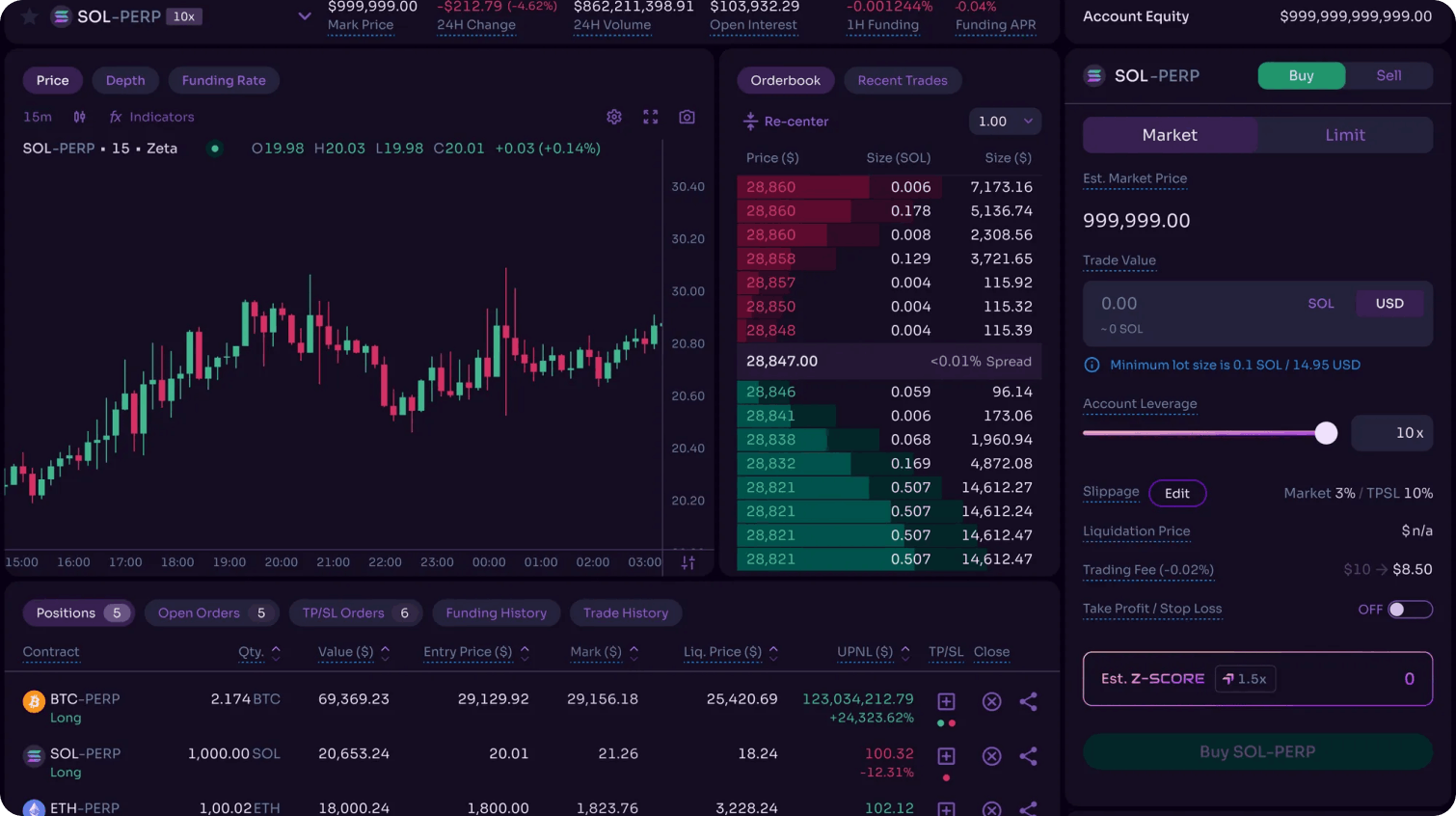

Zeta Markets, a pioneering company in the Web3 and crypto sector, specializes in leveraging blockchain technology for innovative financial solutions. With a complex network of over 100 wallets and millions of transactions, Zeta Markets faced significant challenges in streamlining their accounting processes and financial reporting.

2. Challenges Faced

Zeta Markets’ accounting system struggled under the weight of their expansive and intricate financial activities. The key challenges included:

- Complex Transaction Reconciliation

Managing and reconciling years of data across multiple entities and wallets, each with a myriad of transactions. - Inefficient Financial Reporting

The existing system failed to effectively integrate onchain and offchain transactions, leading to inaccurate financial statements. - Lack of Crypto-Specific Accounting Knowledge

Traditional accounting practices fell short in addressing the unique demands of blockchain-based transactions.

3. Engagement with OnChain Accounting (OCA)

Zeta Markets reached out to OCA for specialized accounting and CFO services. OCA’s expertise in crypto accounting presented an opportunity to overcome the challenges faced by Zeta Markets.

4. Solutions Provided

OCA devised a comprehensive strategy to revamp Zeta Markets’ accounting infrastructure, focusing on several key areas:

Customized Crypto Accounting Software

OCA replaced the existing accounting software with a crypto-specific subledger. This software was tailored to interact seamlessly with Zeta Markets’ diverse transaction types and networks.

Detailed Transaction Reconciliation

Our team undertook the herculean task of categorizing, syncing, and reconciling millions of transactions. This meticulous process ensured accuracy and completeness in financial records.

Integration with Traditional Accounting Systems

We established a bridge between the new crypto subledger and Zeta Markets’ traditional accounting systems, enabling smooth and error-free data transfer.

Comprehensive Financial Reporting

OCA developed a new financial reporting system that accurately reflected every aspect of Zeta Markets’ operations, including the intricate details of blockchain transactions.

Strategic Financial Analysis

Beyond mere reconciliation, OCA provided strategic financial insights, helping Zeta Markets understand the financial implications of their blockchain activities.

5. Results Achieved

The partnership between OCA and Zeta Markets led to significant improvements:

Enhanced Accuracy in Financial Reporting

The new system ensured that every transaction, whether onchain or offchain, was accurately captured and reflected in financial statements

Operational Efficiency

The streamlined process reduced the time and resources previously expended on manual reconciliations and data entry.

Informed Decision-Making

With accurate financial data, Zeta Markets could make informed strategic decisions, enhancing their business operations and growth potential.

Improved Regulatory Compliance

The detailed and accurate financial records facilitated easier compliance with evolving regulatory standards in the crypto space.

Investor Confidence

The revamped accounting system played a pivotal role in boosting investor confidence, as evidenced by successful funding rounds following the implementation of OCA’s solutions.

6. Client Testimonial

Zeta Markets acknowledged OCA’s contribution to their success, highlighting the professionalism, reliability, and in-depth understanding of crypto accounting that OCA brought to the table. The clarity and precision in financial reporting were particularly commended.

7. Conclusion

OCA’s intervention was instrumental in transforming Zeta Markets’ accounting framework. By addressing the unique challenges of Web3 and crypto transactions, OCA not only streamlined Zeta Markets’ financial operations but also equipped them to navigate the complex and dynamic world of blockchain with greater confidence and efficiency.

Don't Hesitate to Invest Now, We Will Give You The Best!

Onchain Accounting stands as your vigilant financial co-pilot, ensuring compliance and peace of mind.

In the innovative realm of Web3 and crypto, Zeta Markets emerged as a key player. Specializing in blockchain-based financial solutions, their goal was to enhance their market presence and impact. The target: secure essential funding to solidify their position as a leader in the Web3 financial sector.

Life with Onchain Accounting

Structured Financial System

OnChain Accounting established a QuickBooks account and a general ledger, bringing systematic organization and accessibility to the startup’s financial data WEB3.

Comprehensive Financial Overview

All past transactions were categorized and inputted into QuickBooks, providing a clear picture of the company’s financial history.

Strategic Financial Forecasting

A robust two-year forecast was created, detailing the allocation and strategy for the $8.5 million seed funding, aiding in effective market entry planning.

Enhanced Investor Confidence

The clean financial statements and budget forecast prepared by OCA enabled the startup to approach their seed round with a compelling narrative, successfully securing the $8.5 million funding.

Informed Financial Decision-Making

With a clear financial roadmap and back-office support from OCA, the startup’s management team could make better-informed financial decisions, driving the company towards its strategic goals.

Life before Onchain Accounting

Disorganized Financial Records

The startup faced a chaotic situation with two years of financial activity scattered across various credit cards and bank accounts, lacking any systematic organization

Lack of Financial Transparency

Without a traditional ERP or crypto sub-ledger, the startup struggled to provide transparency regarding their token sales and liquidity allocation, essential for building trust with followers and investors.

Inadequate Financial Forecasting

The absence of a structured financial strategy and forecast hindered the startup’s ability to plan effectively for market entry and use of potential funding.

Limited Financial Decision-Making Capability

Without a comprehensive view of their financial situation, the startup’s management team faced difficulties in making informed financial decisions WEB3.