Secure Your Crypto Wealth: Cold Storage Best Practices for 2023

10th Dec 2023

Table of Contents

Choosing the Right Cold Storage Device

Secure Setup of Cold Storage Solutions

Maintaining Security After Initial Setup

Conclusion & Future Expectations

With the growth of the cryptocurrency market, more investors are looking to secure their crypto wealth for the long term. Cold storage offers one of the most secure methods for protecting your investment from cyber-attacks and unauthorized access. This guide covers expert-recommended best practices for utilizing cold storage in 2023.

1. Choosing the Right Cold Storage Device

Selecting the appropriate cold storage device is the critical first step to securely storing your private keys and seed phrases. The two main options each have unique advantages:

Hardware Wallets Offer Maximum Security

Hardware wallets like Trezor or Ledger provide excellent cryptographic security in tamper-proof physical devices. Features that enhance their security level include:

- Built-in display screens – Allows you to independently verify wallet addresses and transaction details without risk of malware manipulating the info.

- Password protection – Password requirements add another layer of authentication beyond physical possession of the device.

- Secure chips – Wallets like the Ledger Nano X utilize a CC EAL5+ certified secure chip while the Trezor Model T employs a custom ATECC608A cryptographic microprocessor. These make extracting seeds and keys extremely difficult.

- Anti-malware design – With no exposed ports, vulnerability to viruses, spyware or keylogging malware is practically eliminated.

Simple interfaces also make leading hardware wallets easy to set up and use while still providing bank-grade security. For most investors, hardware is the superior cold storage choice.

Paper Wallets Require Precise Usage

Paper wallets have benefits when created and stored properly:

- No digital vulnerabilities – Printed keys aren’t exposed to online threats.

- Low cost – Requiring just paper and a printer makes this the cheapest cold storage option.

However, serious security risks appear if users reuse paper wallet keys or fail to store them safely from physical access, moisture, or damage. Used correctly as single-use wallets kept in weatherproof containers, paper wallets can serve as reliable backups to hardware wallets for disaster recovery scenarios.

2. Secure Setup of Cold Storage Solutions

The actual setup process greatly impacts the resulting security level of your cold storage solution. From initial key generation to sending funds, precise protocols must be followed.

Key and Seed Generation

All hardware and paper wallets rely on generation of private keys and seed phrases – human readable mnemonics representing the keys needed to control the wallet’s funds.

It’s critical that the computer used has no existing malware and the wallet hasn’t been tampered with. For hardware devices, use the onboard key generation directly on the wallet if available.

Once created, immediately back up the mnemonic phrase securely. Store one copy securely in a location away from your main home to enable recovery in case of fire, flood or other incident. Consider a safe deposit box or trusted relative’s house for disaster-proof storage.

Sending Assets to Cold Storage

When first loading assets like BTC and ETH into your cold storage:

- Start by sending a tiny test transaction to the receive address shown on the cold wallet interface to confirm accuracy.

- After the test confirmations complete successfully, send the full balance in a single large transaction. This avoids leaving remaining small balances in hot storage needlessly exposed.

- Always verify the entire receive address on the cold wallet itself if possible. Malware on the transmitting device could alter copied addresses.

These simple habits drastically minimize the chances of assets being sent to incorrect or fraudulent addresses.

Safeguard your cold storage device against physical theft or damage:

- Use a durable case or weatherproof bag for hardware wallets, safe from moisture and drop damage.

- Keep paper wallets in labeled, opaque containers for organization and to prevent external wear or ink degradation.

- Store cold wallets in secure locations like a locked safe, safety deposit box, or home security vault anchored to the building foundation.

The setup process for your cold storage wallet lays the foundation for keeping your crypto assets protected. From the moment of key creation through asset transfer, specialized protocols should be followed to maximize security.

Key and Seed Generation

All cold wallets rely on generation of private keys and seed phrases – human readable words representing the cryptographic keys that control the wallet.

It’s critical that the device used for key generation is completely free of existing malware and the wallet hardware itself has not been tampered with. For hardware wallets, use the on-device random key creation if available rather than relying on a connected computer.

Once the private key is created, the wallet produces a “seed phrase” – typically 12 to 24 words providing a backup of the key. If the hardware is ever lost or damaged, the seed phrase can be used to reconstruct the private key and recover the funds.

- Backup Storage Locations*

<!—->

- One copy of the seed should be stored securely in a location away from your main home. This enables recovery even in case of catastrophic loss events like fires, floods or theft.

- Consider a bank safe deposit box rented anonymously or a trusted relative’s house for disaster-proof storage. The location should not be discoverable by outsiders.

- A complex passphrase can also be combined with seed words for added protection.

By keeping the sole original copy of the seed phrase secure, loss scenarios become highly survivable while maintaining strict cold storage.

Sending Assets to Cold Storage

When first transferring cryptocurrency assets like BTC and ETH into your cold storage wallet:

- First send a small test transaction to the receive address shown in the cold wallet interface to confirm accuracy.

- After the test transaction completes successfully, send the full intended balance to the address in a single large transaction. This avoids leaving remaining funds needlessly exposed in the sending wallet or on an exchange.

- Always verify the entire receive address on the cold wallet screen or device interface. Keylogging malware could manipulate copied addresses during computer clipboard pasting.

These habits drastically reduce the risk of assets being incorrectly sent to random or fraudulent addresses due to software tampering tricks.

3. Maintaining Security After Initial Setup

Ongoing best practices are also essential for keeping cold storage defenses at full strength as cybercriminal tactics evolve.

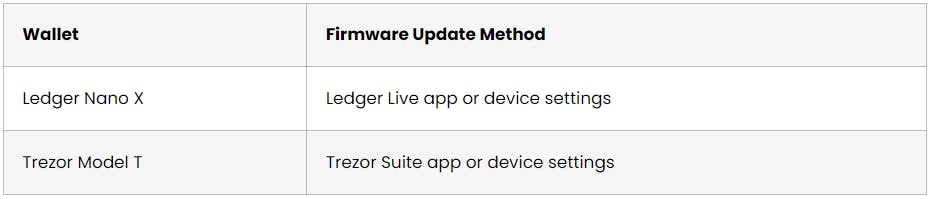

Firmware Updates

It’s easy to forget about firmware updates after the initial setup. However, wallet vendors issue important security patches in new firmware versions:

Periodically connecting your hardware wallet to update firmware could end up preventing a future exploit.

Multisig Arrangements

Multisignature (multisig) support adds powerful checks and balances for large crypto holdings:

- Multiple signers are required to authorize transfers out of the wallet.

- Strong protections if any one key is compromised.

- Allows management by a trusted group like family or business partners.

Both Ledger and Trezor support robust multisig features. Though adding operational complexity, multisig security is worthwhile for high net worth crypto investors.

Proactive Penetration Testing

Penetration testing involves hiring ethical hackers to actively attempt bypassing the security protections on your cold storage setup:

- Tests hardware tamper resistance and simulates physical theft.

- Attempts seed phrase extraction on found or confiscated devices.

- Tries bypassing authentication methods.

Annual testing can uncover vulnerabilities and confirm security arrangements are working as intended, keeping assets protected even in worst case scenarios.

Monitoring Balances

One simple habit that detects problems early is occasionally monitoring wallet balances:

- Helps catch unauthorized withdrawals early before expansive losses.

- Allows time for emergency fund movement if assets are compromised.

- Can reveal lost or destroyed wallet issues needing recovery seed restoration.

Balance snapshots on a monthly basis are typically enough to spot discrepancies and avoid negative surprises down the road.

Estate Planning

The immutable nature of cryptocurrencies presents estate planning challenges after owner demise or permanent incapacitation. Ensure your assets remain accessible to beneficiaries through careful inheritance planning:

- Share sealed copies of recovery phrases or seeds with attorneys, executors and heirs via wills or safe deposit boxes.

- Set multi-approval access with trusted stakeholders as required signers in multisig wallets.

- Keep instructions for logically dividing hardware and keys between surviving partners.

Without contingency preparations, billions in crypto wealth could potentially vanish from circulation upon clients passing away.

4. Conclusion & Future Expectations

Implementing cold storage best practices takes some initial effort but offers confidence your crypto wealth remains fully under your control. As blockchain elegantly eliminates counterparty risk, intelligent cold storage eliminates cyber risk to your accumulated assets.

Ongoing hardware wallet innovation also provides cause for optimism. Future cold storage devices will likely integrate features like:

- Biometric authentication – Fingerprint, iris and facial recognition for fast secure access.

- Easy multisig coordination – Built-in group authorization without manual wallet contracting.

- Quantum algorithm resistance – Protects against future decryption computational power.

Set yourself up for crypto investing success by securing your own keys in robust cold storage now. Follow the expert guidance outlined here to keep your holdings safe using industry-best practices tailored for the coming year.